The February 2025 Economic Advisor, published by ITR Economics for NFFS members, is now available. Please note that you must log in to your NFFS account to see this members-only publication.

Read Now

|

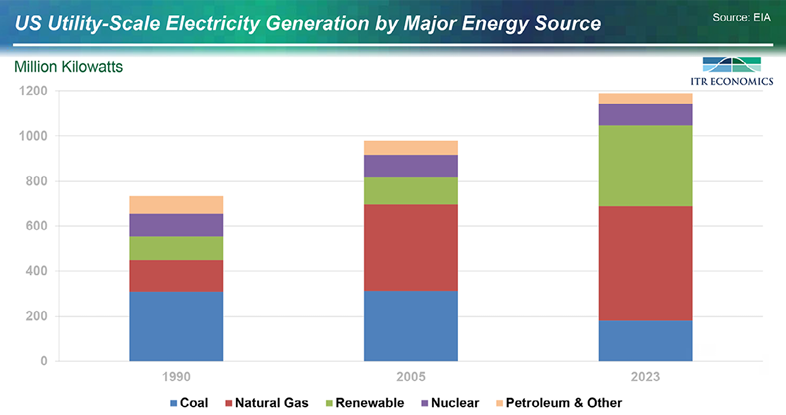

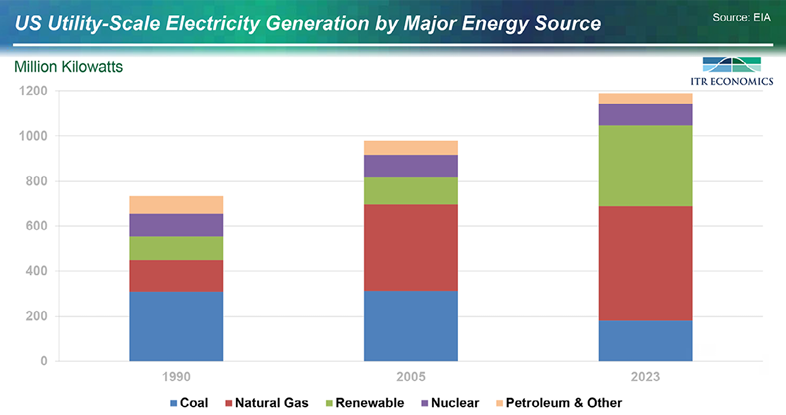

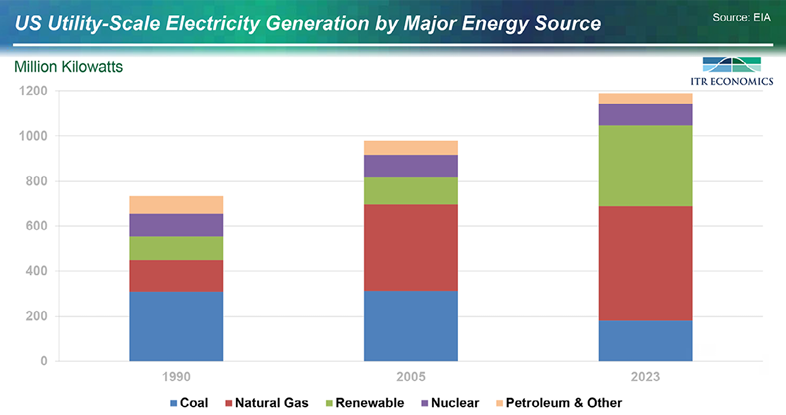

A Closer Look: The U.S. Economy – US Energy: A Powerful Force

by Jenna Allen, ITR Economics

Electricity demand is set to outpace supply as the following factors drive a substantial rise in energy demand:

1. Population growth and economic growth

2. Data center expansion to accommodate digitalization and AI adoption

3. Electrification trends including transport and heating/cooling

4. Higher temperatures and more volatile weather

As a result, we can expect energy prices to generally rise. Businesses should plan carefully for higher prices by taking steps to increase energy efficiency and potentially considering alternative ways to secure energy supply. Read more

|

|

Also in this month's Advisor:

- ITR's Macroeconomic Outlook: "The manufacturing sector is expected to pick up soon despite downside risks primarily in the durables sector, which is below year-ago levels and in recession, depressed by still-high borrowing costs."

- Make Your Move, a monthly tip for managers: "Do not let shifting government spending and tariff policy distract you from preparing for the economic growth, elevated inflation, and elevated interest rates that will characterize the latter half of the 2020s in advance of the 2030-36 depression."

- Investor Update: "Equities started the year generally positive, posting a normal 2.7% increase and ending January at a month-end record high. After a long period of seeing the seven Megacap tech-related stocks – Amazon, Telsa, NVIDIA, Microsoft, Meta, Apple, and Google – drive a huge chunk of rise in the S&P 500’s ascent, leadership in the S&P 500 is showing some broadening signs. This trend is encouraging because it suggests ..."

- ITR Economics' Long Term View: "2025 – Growth; 2026 – Growth..."

- Leading Indicator Snapshot: "Indicators are overwhelmingly flashing green for 2025 apart from the US ISM PMI (Purchasing Managers Index), which has waffled in recent months..."

- Manufacturing Industry Analysis: "US Total Manufacturing Production is relatively flat, with annual average Production coming in 0.2% below the year-ago level in January."

- State-by-State Analysis: Home Prices: "US Home Prices in the three months through November came in 4.4% above the year-ago level; the pace of Prices rise is slowing.."

- Reader's Forum: "What are the impacts of immigration on our economy and labor market?"

|

|